Succession Certificate law, primarily governed by Indian law, pertains to the issuance of a legal document known as a "Succession Certificate." This certificate serves a crucial role in facilitating the transfer of assets and liabilities of a deceased person when there is no valid will (intestate succession). Here is a description of Succession Certificate law in 200 words:

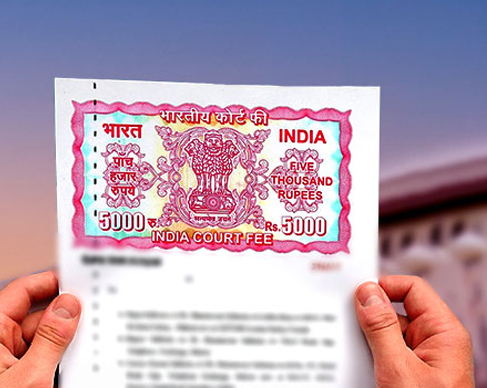

Succession Certificate law falls under the purview of the Indian Succession Act, 1925, and the Indian Evidence Act, 1872. To obtain a Succession Certificate, interested parties, usually legal heirs, must apply to the district or civil court where the deceased individual held assets or resided. The application must provide details of the deceased, the claimant's relationship to the deceased, and a list of assets and liabilities to be transferred.

The court evaluates the application to verify the legal entitlement of the claimants, ensuring that they are legitimate heirs or representatives of the deceased. The Succession Certificate authorizes the claimants to manage and distribute the deceased's assets, including bank accounts, property, and investments, and settle debts and liabilities.

This legal instrument is essential for asset transfer and estate settlement, offering a structured and lawful process for safeguarding the interests of both legitimate heirs and creditors. Succession Certificate law aims to ensure a fair and orderly transition of assets and liabilities, particularly when a deceased individual did not leave behind a will.